Development of a turnkey OTS service

Fast launch. Customized functionality. Customization. Full support.

We develop OTC-platforms with extensible functionality from scratch

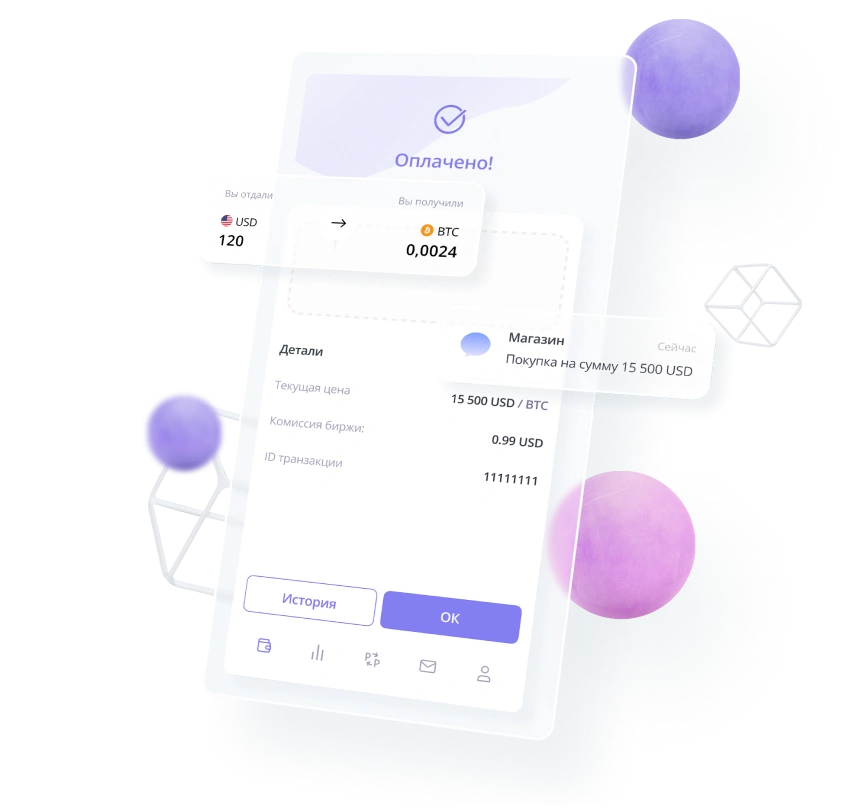

An over-the-counter (OTC) crypto platform is a type of digital currency exchange that operates outside of traditional exchange platforms. OTC platforms enable individuals and organizations to buy and sell cryptocurrencies directly with each other, without intermediaries.

Unlike traditional exchanges, where buyers and sellers place orders on a centralized platform, OTC platforms facilitate transactions between the two parties directly, usually through a phone call or messaging service. OTC platforms are often used for large transactions because they provide greater privacy and less market power than trading on traditional exchanges.

OTC platforms can be especially useful for investors and traders looking to buy or sell large amounts of cryptocurrencies. These platforms tend to have lower commissions than traditional exchanges for large trades, and may also offer additional services such as market research and analysis.

We develop solutions that allow OTC platform owners to choose any functionality, perform numerous integrations with third-party services, help connect payment systems, and provide legal and marketing support.

Technical features and modules of the OTC platform

Trading Engine

Wallets

KYC/AML

Pricing data

User interface

Reporting and analytics

Order Types

API integration

Multiple Currency Support

Escrow services

Margin Trading

The main advantages of having your own OTC platform

High liquidity

Competitive pricing

Customizable terms

Confidentiality

Reduced market power

Personalised service

How to earn on your own OTC platform

Trading fees

Spread

Brokerage Fees

Fees to liquidity providers